Patience required in Calgary’s housing market recovery

City of Calgary, August 1, 2018 – Recent struggles in the job market, accompanied by yet another interest rate increase, is piling on to the decisions potential purchasers have to make in the housing market.

Despite some positive momentum in some aspects of our economy, our job market has continued to struggle as of late

“Despite some positive momentum in some aspects of our economy, our job market has continued to struggle as of late, with some easing in total employment levels over the past few months and persistently high unemployment rates,” said CREB® chief economist Ann-Marie Lurie.

“Also, the Bank of Canada raised rates again in July. Rising costs, combined with a slow recovery, are weighing on the demand for resale homes in the city. At the same time supply remains high and is resulting in an oversupplied market.”

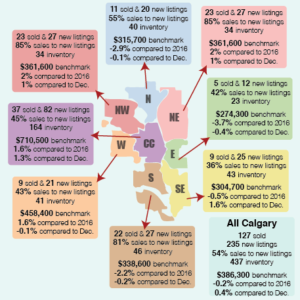

Citywide months of supply have risen for each property type and currently range from nearly five months in the detached sector to seven months in the apartment sector. These elevated levels have been placing pressure on prices in the city.

Detached benchmark home prices totaled $501,300 in July, down 0.4 per cent from last month and over two per cent from last year’s levels. Year-to-date average benchmark prices in the detached sector remain just below levels recorded last year.

The apartment ownership sector continues to see the steepest declines, with year-to-date benchmark prices averaging $257,343, three per cent below last year and nearly 14 per cent below 2014 highs.

“In a buyers’ market, it’s critical for all parties to have the most up-to-date information to make a fully informed decision, whether you are buying or selling,” said CREB® president Tom Westcott.

“A REALTOR® can help make an accurate determination on how much to sell a home for or how much is too much when purchasing one.”