Selling or buying a condo? Condominium owners are part owners in a corporation. A seller must provide the buyer with a long list of condominium documents. What are the documents that a seller must provide to the buyer? And what do these ‘condo docs’ tell? Following is the entire list of condominium documents, which is part the purchase contract between seller and buyer.

Selling or buying a condo? Condominium owners are part owners in a corporation. A seller must provide the buyer with a long list of condominium documents. What are the documents that a seller must provide to the buyer? And what do these ‘condo docs’ tell? Following is the entire list of condominium documents, which is part the purchase contract between seller and buyer.

(1) An information statement that includes all of the following:

- the particulars of:

- any action commenced against the corporation in respect of which the corporation has been served, including the amount claimed against the corporation

- any unsatisfied judgment or order for which the corporation is liable and

- any written demand made on the corporation for an amount in excess of $5000 that, if not met, may result in an action being brought against the corporation

- a statement setting out the amount of the capital replacement reserve fund

- a statement setting out the amount of the contributions and the basis on which that amount was determined

- a statement setting out any structural deficiencies that the corporation has knowledge of at the time of the request in any of the buildings that are included on the condominium plan

- loan disclosure statements for current loans, including documents showing the starting balance, current balance, interest rate, monthly payment, purpose of the loan, amortization period and default information, if applicable

This information statement is also known as disclosure statement and is very important to the buyer. It’s the management company who provides this statement, and it always needs to be up to date. Therefore, most management companies charge for this document, and it may cost several hundred dollars. This disclosure statement is specific to the unit, and it states a number of things.

(i), (ii) and (III), or the first 3 points, are regarding any legal actions against the condo corporation.

- The management company confirms the dollar amount that is in the reserve fund as of a particular date.

- A statement setting out the monthly condo fees (also known as contributions) for the particular unit.

- Any information about any structural defects in the building. It is important for a buyer to know about defects, since this can impact the financials in the (near) future

- It is not very common in Calgary, but sometimes condo corporations take out a loan to pay for large upgrades or for necessary improvements. If there is a loan in place, this disclosure statement shows the specifics of this loan. In most cases, a loan impacts the monthly fee that a buyer pays on top of regular condo fees.

Every condo corporation that is managed by a professional management company has a service agreement in place. The current management company should be registered on the CADS, the Condominium Additional Plan Sheet of the corporation. If a condo complex is self managed, this service agreement document is not needed, since there is no agreement in place.

Snapshot of a Reserve Fund Study

Some condo complexes have a recreational facility on the premises, such as gym or swimming pool. Sometimes, owners can use any recreational facilities such as swimming pool or gym that is located in another complex, or non-owners can use these facilities of a condominium complex. In either scenario, some agreement must be in place.

Post tension cables were used in the 1970’s and 1980’s in some concrete condo buildings. Their purpose was to reinforce the construction. These cables need to be maintained on a regular basis. As well, they must be checked by engineers for deterioration. Therefore, post tension cables are an extra cost. The management company must confirm existence of post tension cables in a condominium complex.

Every corporation has an operating budget, and so does every condominium corporation. A budget is the yearly overview of all the incoming condo fees and all the outgoing expenses such as maintenance, utility costs, snow removal, landscaping, and so forth.

The financial statement shows how money was spent in the previous 12 months. These financial statements include an income statement and a balance sheet.

Sellers are required to provide the most updated bylaws of the corporation. Obviously, the bylaws state important and enforceable rules and regulations regarding the condo complex. A few important sections are about pets, the use of (visitor) parking, the guidelines for renovations, the use of the gym, how board members are elected etc. The CADS, the Condominium Additional Plan Sheet shows the most updated bylaws that are in effect.

A snapshot of the condo contributions

- all approved minutes of all general meetings of the corporation, if available

- draft minutes of general meetings, if approved minutes are not available, for meetings that occurred at least 30 days before the date of the request, and

- approved minutes of board meetings

The minutes are recorded at every meeting. The seller must provide the buyer all the available minutes from, at least, the previous 12 months.

Condo complexes in Alberta use a system where a fixed number of ‘unit factors’ are divided over all the units. Usually, there are 10,000-unit factors and these 10,000 unit factors get allocated by the square footage of each unit. With this system, things like the condo fees are established. In essence, the higher the square footage, the higher the condo fees. These unit factors were disbursed and recorded on the condominium plan when the complex was built.

In some condo complexes, the parking stalls and storage units are leased, versus owned. If that is the case, a lease agreement between condo corporation and owner must be in place.

A board is allowed to make new or amend existing rules. The seller must provide the buyer with these new rules.

The seller must provide the buyer with any resolution or ruling that was voted on. For example, the members or board of a condominium complex can vote on allowing pets, or making the building non-smoking. An ordinary resolution is usually related to the day-to-day operations of the condominium.

A seller must provide any documents from professional engineers, such as for post tension cables, issues with balconies etc.

Every corporation must be insured for water, fire, flood, as well as for liability. A seller must provide the proof of insurance purchased by the condo corporation. The property management company provides this document.

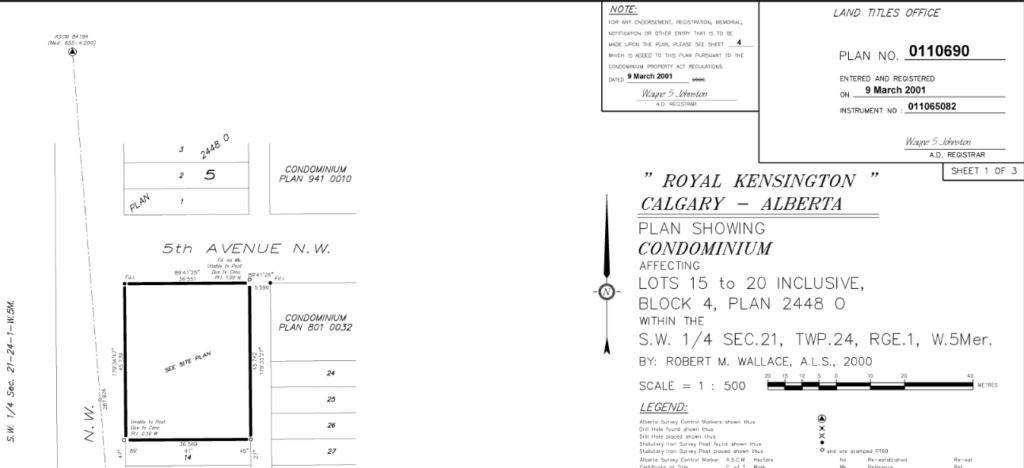

Snapshot of a registered Condoplan

The insurance policies go with the insurance certificate (see 14). As with any insurance policy, it shows what is insured, how it is insured and for how much it is insured. Think of flood, fire, hail, liability, etc.

Also known as SIUD, a description of what is covered by the insurance company of the corporation. Anything more expensive in the unit than described in this SIUD is for the insurance of the unit owner.

The reserve fund plan is essentially a budget for long term. It can cover 5 to 25 years. It lays out all the future expected costs such as a new roof, new windows, siding, elevators and other expensive items in a building. The reserve fund plan needs updating at least every 5 years.

Two more important documents for condos: CADS and Estoppel

The list above is long, yet two important documents are missing. CADS is one document. CADS stands for Condominium Additional Plan Sheet. This document is filed at Land Titles. CADS shows, for example, the changes in board members, any changes in the bylaws, the address for the service of the condo complex, to name a few. The seller used to be obligated to supply this document. However, it was taken off the list in or around 2020. If it is not added into the contract manually by the buying realtor, the buyer needs to purchase this document for $10 at Land Titles.

Another important document for a buyer is the Estoppel certificate. The Estoppel is also issued by the condo management company, but only at the moment of closing. Therefore, it is not written into the list on the purchase contract. The Estoppel repeats much information already issued in the documents as mentioned above. The big difference is that now the lawyer gets this information on the last day before changing ownership. The Estoppel shows, amongst other things, the monthly contributions and if there are any arrears. It also shows the financials and how much money is in the reserve fund. Often, there is a time lapse between the purchase and the possession. Obviously, financials of a corporation can change in the meantime, and now the lawyer gets an official statement to check one last time, before changing ownership.

Buyer beware on condo documents

The seller must provide the buyer with a serious list of documents, as explained above. Then, the onus is on the buyer to interpret and understand all these documents. Most documents are clear and rather easy to understand. The bylaws, for example, contain many pages to read through, yet most people would understand them. Also, the minutes will give the buyer a clear picture of anything that is going on in the condo complex.

However, for most of us, the financials of the condo corporation are slightly more complicated. Yet, the financial side of a condo complex is extremely important. Every condo complex receives monthly condo fees (aka contributions) from the owners. Basically, these condo fees go in two directions. One portion of the condo fees is for the daily operations, and the other portion of the funds goes into a reserve fund. The reserve fund is the savings account for future and larger expenses, such as new windows, roof and siding. If something needs repair, and there are not enough funds in the bank account of the corporation to pay for the repair, the condo owners may be asked to pay out of pocket. This is called a ‘special assessment’.

Condo Document Review Specialist

In Calgary, there are several Condo Document Review Specialists who can help a buyer ‘decipher and decode’ the financials and other documents of a corporation. These specialists charge several hundred dollars for a review. For any buyer without the skills to understand the financials, this is money well spent. Buying into a condo complex with a healthy position on the financials help the buyer avoid any special assessments in the near future.

The Certified Condominium Specialist

Buying a condo is a little different from buying a single-family home. This difference comes back to the fact that a condo is a corporation. Anyone who owns a unit in the complex or building is now part-owner of that corporation. This takes much more due diligence than buying a single family home; hence the information above. The Calgary Real Estate Board offers extra education to realtors for buying and selling condos: Certified Condominium Specialist. Apartments, townhouses and even single-family homes that are registered as bareland condos are all covered in this extra course.

Tanja van de Kamp is a Certified Condominium Specialist and can give a buyer or seller peace of mind that nothing is overseen, resulting in a smooth process. So, if buying or selling a condo, contact Tanja van de Kamp at 403 978 5267.

Please note: The above is general information and not considered legal advice. We do our best to write informative articles about real estate in Calgary, Alberta. If you have any questions or concerns about our comments, please feel free to contact us or speak to your legal advisor.