Between the start of the home search and receiving the keys of a new home, a home buyer has to pay some costs. We often refer to these costs as closing costs. What closing costs can you expect in Calgary, Alberta?

Between the start of the home search and receiving the keys of a new home, a home buyer has to pay some costs. We often refer to these costs as closing costs. What closing costs can you expect in Calgary, Alberta?

Please note that these closing costs are subject to change and are based on gathered averages. Last updated March 2024.

Home inspection

On average $400 to $700. Most buyers have a home inspection done, which is written as a condition into the purchase contract. A home inspection in Calgary is roughly between $400 and $700 for an average sized home. Be aware that this closing cost is higher for larger homes. This home inspection fee may be the best investment of your life. And even if nothing comes out of the home inspection, it is certainly worth one’s peace of mind!

Home inspection on a condo

$200 to $400. Home inspections on a condo are usually cheaper because there is less to inspect. On average, an inspection on a condo in Calgary varies between $200 and $400. Is it worth it do a home inspection on a condo? Our advice is to still do a home inspection on a condo. More than once, an inspector found leaks with a thermal imaging device and appliances not working.

Home inspection on a new built home

Is it worth it to do a home inspection on a brand new home? Again, our advice is to do a home inspection on a brand new home, as well. Builders work with deficiency lists, and with a home inspection in hand, this list can be addressed by the builder.

Additional cost after the home inspection

During the home inspection, certain things can be discovered that require more attention. Think about electrical issues, structural or foundation issues, mold and asbestos. It may be possible that a buyer needs to spend extra money on more testing or get a second opinion from a certified professional.

Condo document review

$300 to $500. When buying a condo, a very important requirement is the condo document review. Calgary has several companies specializing in reading and interpreting these condo documents and charge around $300 to $500. The reviewer examines the bylaws and the financials. The financials are especially important for understanding if any special assessment is lingering.

Water well and septic field test

$1000 and up. When buying an acreage, it is strongly advised to have both the water well and septic system tested. The quality of your water, the flow rate of the well, the state of the septic system are very important things to know about before stepping into acreage life. The cost to expect for these tests can vary a lot. Charges for a septic system inspection ranges from $350 to $500. The cost for a well inspection can be between $1000 and $1500.

Lawyer

$1200 to $1800. Hiring a real estate lawyer is always part of the buying process. On average, a lawyer in Alberta costs a buyer about $1500. Usually, the lawyer fees are from about $800 to $1000, and any remaining costs are reimbursements. The lawyer takes care of a (long) list of tasks, including transferring the funds, checking title and the real property report, clearing title, registering the new owner on title, etc, etc.

Realtor fees

Depending on brokerage. In most cases, in Calgary, the realtor fees are paid for by the seller. However, officially, the seller pays the selling brokerage, and the selling brokerage shares the commission with the buying brokerage. It is also possible that the seller does not offer the commission that the buying realtor charges. That means there is a shortfall. In our experience, a shortfall rarely happens, and we can honestly say that in 99.99% of the transactions there is no money out of the pocket of the buyer. In the rare case that we see a shortfall, it is often with discount brokerages, builders and self-represented sellers.

Appraisal fee

$300 to $500. Many lenders ask for an appraisal before they decide to lend the money. The lender wants to make sure that the value of the property is about equal to the money they lend. This appraisal cost is on average between $200 and $400. Sometimes the lender will absorb this appraisal fee; however, sometimes the buyer must pay for the appraisal.

Mortgage insurance

Depending on down payment. This is often referred to as CMHC insurance. These premiums vary and depend on the amount of the buyer’s down payment. A buyer does not pay any insurance premium if the down payment is 20% or more. If the down payment is less than 20%, a premium is charged. This mortgage insurance is a cost that can be added to the monthly mortgage payment or can be paid as a single lump sum. There are several mortgage insurance companies. The CMHC is a government body and, therefore, most widely known by the public. Sagen, formerly known as Genworth, is a private company with the same service. Their insurance rates are very similar, and so is their goal: insure mortgages to protect lenders in case the borrower defaults on mortgage payments. For the most accurate insurance premiums, visit the CMHC.

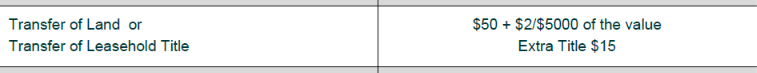

Land transfer fee

Depending on home value. Alberta does not have a land transfer tax. Instead, there is a land transfer fee. This land transfer fee is several hundred dollars and depends on the value of the home. For the most recent rates, visit www.Alberta.ca. Not having this tax in Alberta is a great gift! Most provinces in Canada do charge these taxes and cost buyers thousands of dollars! The real estate lawyer takes care of these fees, and a buyer reimburses the lawyer. Please note that the Land transfer fee in Alberta is subject to increase in Spring of 2024.

In Alberta, Land Transfer Fee for a home of $400,000 calculates to $210. ($400,000/$5,000 x $2,00 +$50,00)

Title insurance

$200 to $300. Many lenders require a title insurance. This is an insurance for the lender (and the buyer) against, for example, title fraud and potential deficiencies on the Real Property Report. In Alberta, title will cost from around $200 to $300 for the average home. Usually, the lawyer purchases title insurance on behalf of the buyer, and the buyer reimburses this closing cost.

Deposit

Clearly, a deposit is not a closing cost. However, it is money out of your pocket for some time. The deposit is ‘good faith’ money that goes along with the offer to purchase and while conditions are being fulfilled (or satisfied). If the conditions are fulfilled and the home sale is firm, then this deposit goes towards the down payment. But if the conditions are not being fulfilled, the deposit is returned to the buyer. Only when a buyer ‘walks away’ from the home after waiving the conditions and before possession does the buyer lose the deposit. Also, the sellers can sue for other damages such as a lower selling price to a next buyer.

GST

There is no GST on resale homes when you buy a home in Alberta. If it is a new-built home, GST is applicable. However, when buying a brand-new home this GST is included in the contract price. Read more about GST and real estate at the website of the CRA.

Moving cost

Whether hiring a professional moving company or doing it your self by renting a U-Haul, expect some costs for moving homes.

Other costs a home owner must expect

The above-mentioned costs are considered closing costs because they are part of the home purchase process. However, every buyer also needs to take these ongoing cost into consideration.

Home insurance

Obviously, insurance on a home is important against fire, flood and other kinds of damage. A lender will not issue the mortgage funds if the buyer does not have proof of home insurance. Insurance can be considered a closing cost, although it is a cost which comes back yearly.

Property taxes

Property taxes vary per property and per community. Every listing on the MLS indicates the property taxes from the current year, or the year before. Always verify the property taxes with the city.

Condo fees

Every condo requires a monthly contribution to cover many different costs. Think of general maintenance, building improvements, snow shoveling, landscaping, garbage collection and many more items that are usually covered by the condo fees.

HOA fees

Some Calgary communities charge Home Owners Association fees. These fees go to beautifying the community, upkeep on a clubhouse etc. HOA fees in lake communities are often higher but allow use of the lake for recreational activities. Also, sometimes, amounts can differ within parts of one community. We see HOA fees in Calgary range between $65 and $490 per year. Always check with the community for the exact amount. HOA fees are registered on title as well.

Utilities

Gas, electricity, water and sewer are all monthly costs, depending on the usage and the provider. Utility providers may ask for an administration cost or a deposit when signing up.

Maintenance

Every home needs maintenance and, obviously, the costs depends on many factors.

Free Moving Tips & Checklist

Free Moving Tips & Checklist

Disclaimer: this article is written for Calgary and estimates are based on experience within Calgary.